Revenue Monitoring

Real-time trading monitoring

Gain granular visibility into your positions and improve your cash management, order execution, and clearing and settlement.

Uncover hidden insights

Easily identify trading issues and take appropriate action. Anodot automatically analyzes the vast volumes of trading data to detect anomalies in top-line KPIs:

User access & behavior

Trades

Order execution

Limits & errors

Liquidity & positions

Clearing & settlement

Can you effectively manage your trading platform?

Trading platforms and financial services organizations typically serve millions of traders and must manage millions of daily business metrics involving trades, positions, pricing and order execution, liquidity, regulatory and credit limits, and clearing and settlement, among others. Traditional monitoring solutions based on rule engines or manual thresholding create constant alert storms and cause significant delays in detecting and resolving critical incidents. This directly impacts customer satisfaction, brand equity, regulatory compliance and the company’s bottom line.

Since business data is so volatile and complex, static monitoring approaches based on dashboards and manual thresholds aren’t sensitive, robust or agile enough to effectively monitor trading activity data. With today’s volume, velocity and variance of data, AI-based complete data coverage — regardless of content — and early detection of trading issues and business system failures is essential for keeping business on track. AI/ML-based autonomous solutions are critical for achieving business outcomes and avoiding blind spots.

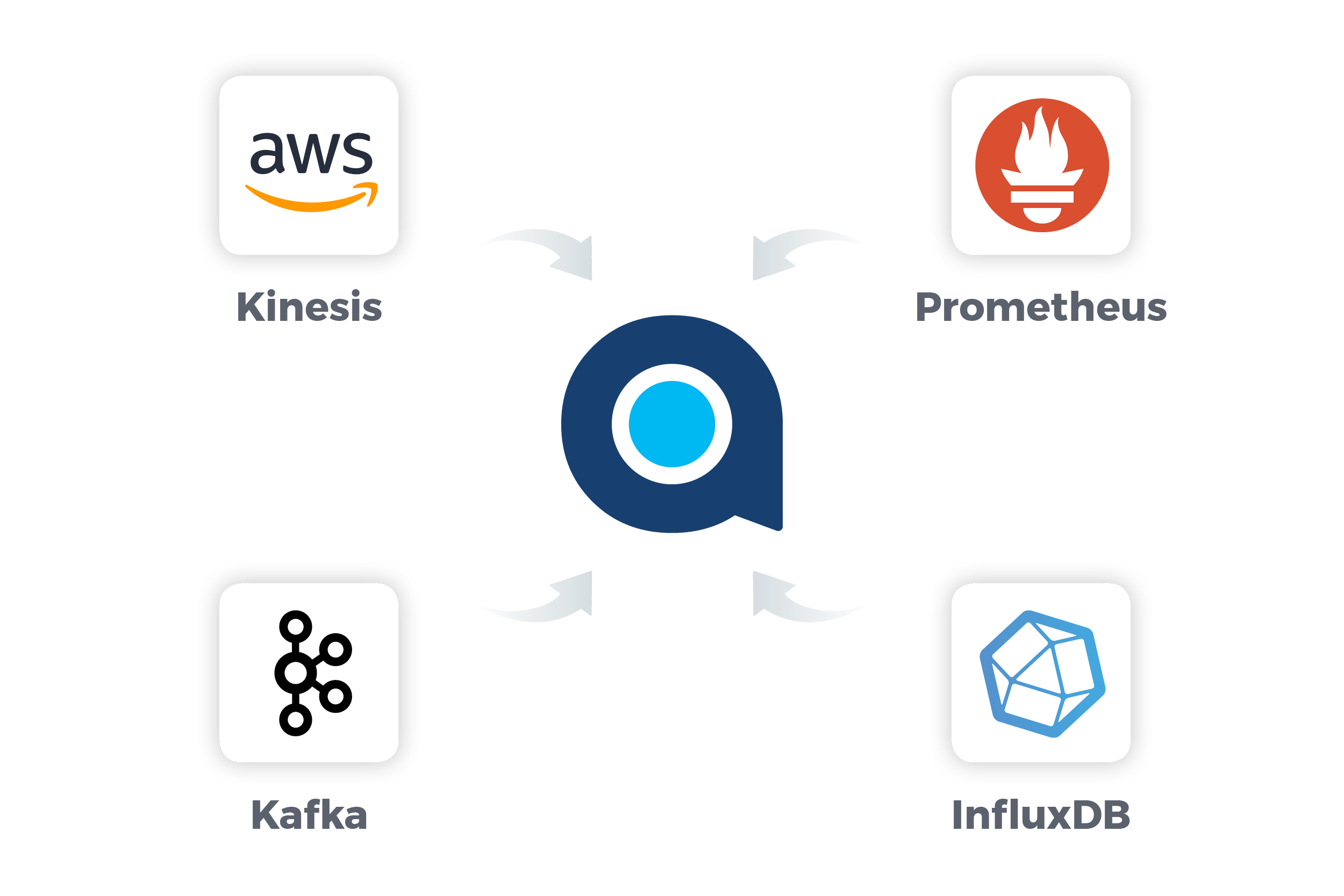

Integrate your data sources

Anodot uses patented technology to autonomously monitor 100% of your data in real-time. Simply use our API or one of our built-in collectors to integrate data from applications, databases and streams for a comprehensive, correlated understanding of trading anomalies. Anodot learns the normal behavior of all your trading metrics and constantly monitors their every move.

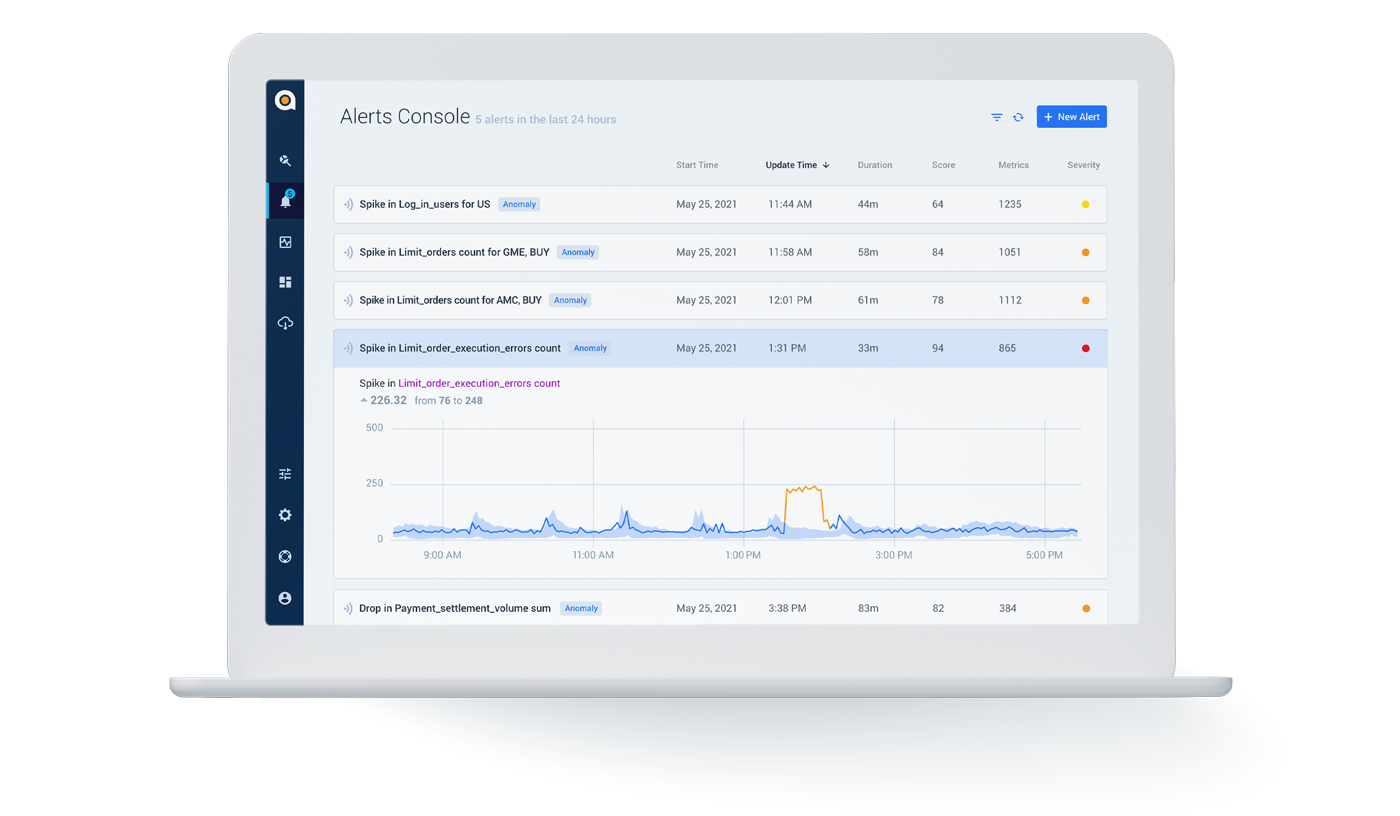

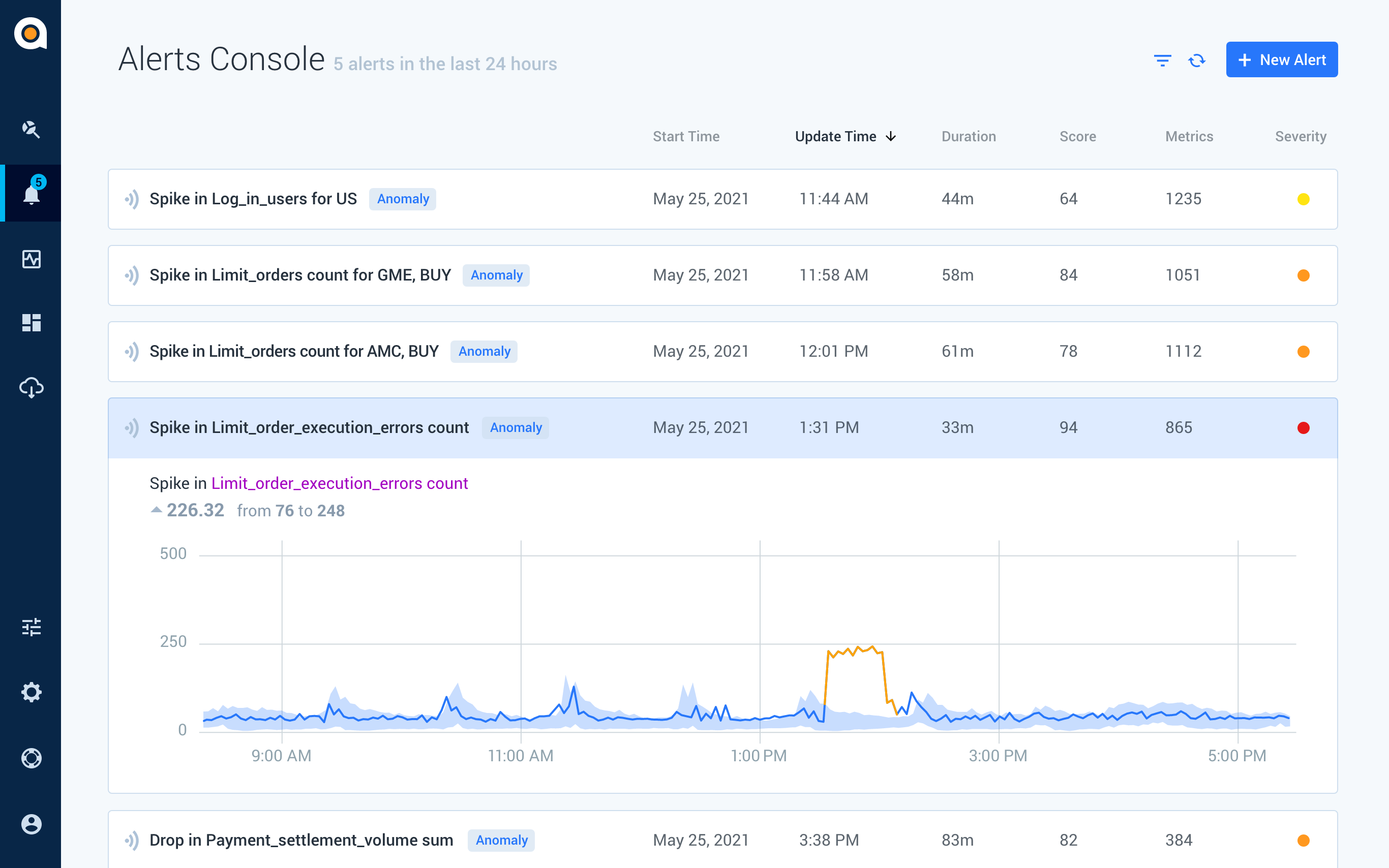

Actionable insights in real-time

Anodot autonomously distills billions of data events into the single spot-on alerts that you need to know about right now, so you can detect trading issues faster. Anodot’s patented correlation engine groups correlated anomalies and identifies all events and contributing factors for each incident, for the fastest time to resolution. Alerts are seamlessly integrated into your existing workflow through text, email, Slack, Jira, Webhook, PagerDuty or any of your other favorite channels.

Autonomous trading monitoring

Anodot’s machine learning capabilities make it a completely autonomous solution. There’s no need to define what data to look for or when, no manual thresholds to set up or update. Anodot’s adaptive alert dashboard is easily used to create advanced trading activity monitors. The system’s alert reduction mechanism ensures that you can leave alert storms, false positives, and unidentified incidents behind.

Take your business monitoring to the next level

Monitor all your data

Detect first

Fully autonomous

Fully autonomous

Payments Monitoring