What Is a FinOps Framework?

FinOps, or Financial Operations, is a practice aimed at managing cloud costs. It brings together technology, business, and finance professionals to ensure cloud spending is transparent, optimized, and aligned with business objectives. Key to its philosophy is the continuous improvement of processes and the efficient use of cloud services.

The FinOps framework provides guidelines and practices to achieve financial accountability in the cloud. It emphasizes the shared responsibility for cloud costs and encourages actions that contribute to the financial health of an organization. As cloud usage grows, FinOps is becoming more popular among companies looking to maximize the value of their cloud investments.

In this article:

- Key Principles and Components of the FinOps Framework

- The FinOps Lifecycle

- What is Required to Implement FinOps?

- FinOps Challenges and Solutions

- Best Practices for Successful FinOps Implementation

Elisha Ben Zvi

VP R&D, Anodot

Elisha is a seasoned R&D leader with over 20 years of expertise in AI-driven business monitoring and cloud cost management.

TIPS FROM THE EXPERT

1. Leverage cloud cost anomaly detection

Use AI-powered tools to automatically detect and alert on unexpected spikes in cloud costs. This enables teams to address issues quickly, preventing small misconfigurations from escalating into significant budget overruns.

2. Align FinOps KPIs with business outcomes

Ensure that the KPIs you track (e.g., cloud unit costs, utilization rates) are directly linked to business goals, such as customer acquisition cost or revenue growth. This alignment helps teams make decisions that are not only cost-effective but also aligned with strategic objectives.

3. Implement continuous optimization reviews

Regularly schedule optimization reviews to assess cloud usage patterns and identify cost-saving opportunities. Revisit reserved instances, savings plans, and workloads to ensure they still meet your organization’s needs, adjusting as necessary.

4. Focus on real-time cost visibility tools

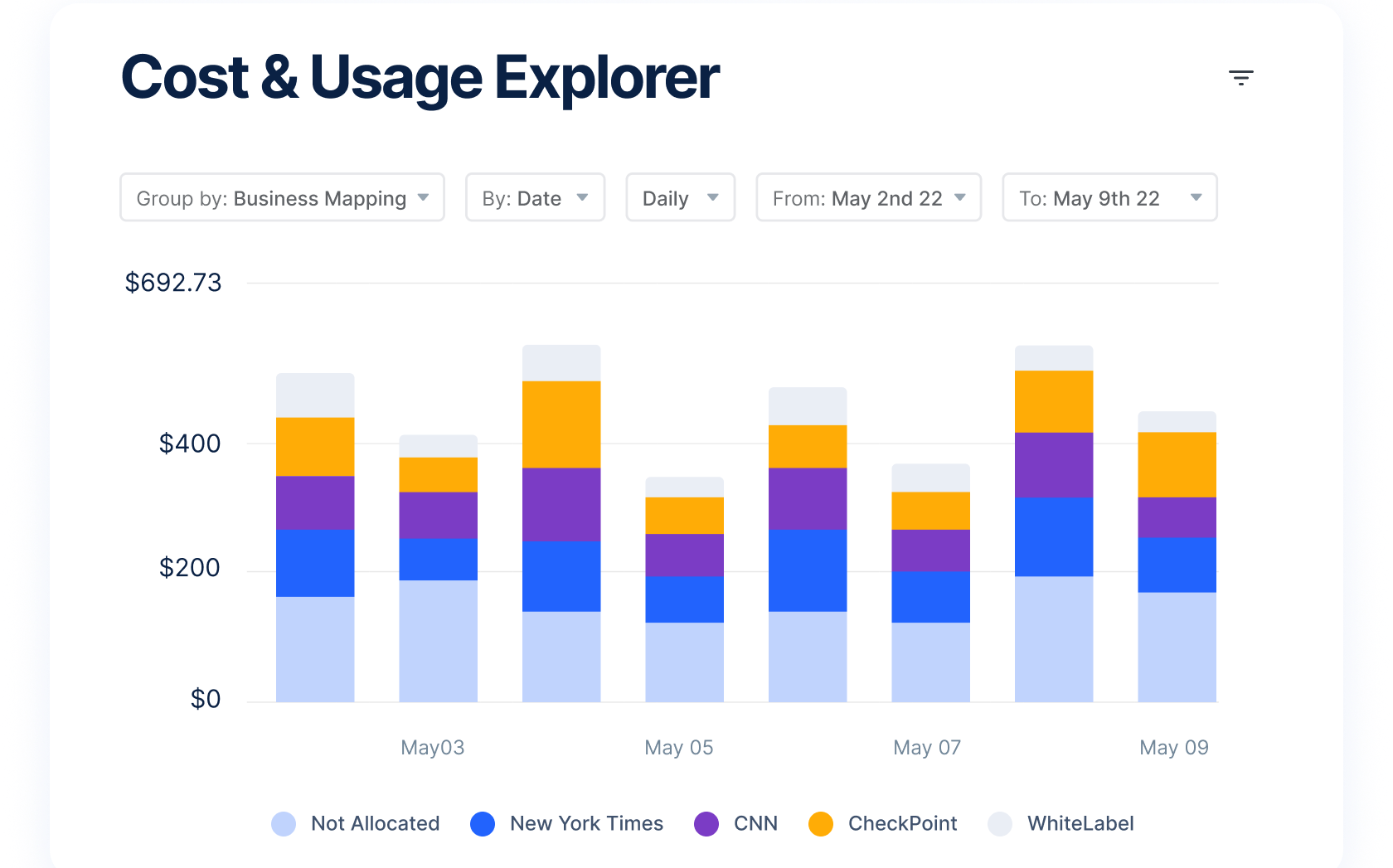

Utilize real-time dashboards to provide immediate insights into cloud spend and resource utilization. This reduces reaction time when costs deviate from expectations and ensures timely decision-making to stay within budget.

5. Set up FinOps training and certification programs

Equip teams with the knowledge and skills to manage cloud costs effectively by offering FinOps training and certifications. This investment in education ensures teams are capable of implementing FinOps principles and maintaining optimized cloud operations.

Key Principles and Components of the FinOps Framework

The FinOps framework, maintained by the FinOps Foundation, covers these areas.

Collaboration

FinOps involves cross-functional teams working together, sharing insights, and making informed decisions. The goal is to break down silos between departments, fostering a culture where financial accountability applies to everyone. This approach ensures that decisions regarding cloud usage and investments are aligned with the company’s financial goals.

Effective collaboration requires clear communication channels and regular meetings. These enable the sharing of cost data and strategies among team members, ensuring that each department understands how their actions impact overall cloud costs.

Accountability

Accountability in FinOps ensures individuals and teams understand their impact on cloud costs. This requires assigning clear responsibilities and setting expectations for cloud usage and expenditure. Departments must take ownership of their cloud costs and actively seek ways to optimize their resources.

To foster accountability, organizations must establish clear metrics and KPIs. These should be regularly monitored and reported to all stakeholders. This visibility promotes responsible behavior while enabling swift corrective actions when necessary, ensuring cloud costs meet the organization’s targets.

Transparency

The FinOps framework requires making all cloud costs visible and understandable to stakeholders. This involves detailed tracking and reporting of cloud spending and usage, ensuring that there’s no ambiguity about where and how resources are being consumed.

With transparency, teams can identify inefficiencies and areas for optimization. It encourages informed decision-making and helps establish trust among departments. Transparency also supports accurate budgeting and forecasting, crucial for managing cloud costs.

Related content: Read our guide to cloud cost monitoring

The FinOps Lifecycle

Here’s an overview of the main stages of the FinOps lifecycle.

1. Inform

At this stage, the focus is on providing visibility into cloud costs and usage. It involves gathering and analyzing data to understand how resources are allocated and consumed, and then informing the relevant stakeholders. This knowledge creates the foundation for cloud financial management, allowing teams to identify trends and make data-driven decisions.

2. Optimize

Optimization in the FinOps lifecycle revolves around continuously improving cloud cost efficiency. It involves identifying underutilized resources, leveraging reserved instances or savings plans, and refining architectures to reduce costs without compromising performance. Optimization efforts adapt to changing usage patterns and business needs.

3. Operate

Operating in the FinOps lifecycle involves managing and adjusting cloud usage in real time. This stage maintains the balance between performance, cost, and compliance, considering the dynamic nature of cloud computing. It requires automation and tooling to monitor usage and costs continuously. Alerts and policies help prevent budget overruns and ensure adherence to governance standards.

What is Required to Implement FinOps?

Organizations implementing FinOps typically go through the following steps:

- Establish a dedicated FinOps team: Implementing FinOps requires forming a dedicated team that understands both the financial and technical aspects of cloud computing. This team is responsible for bridging the gap between IT and finance departments.

- Define clear roles and responsibilities: It’s crucial to clearly define the roles and responsibilities within the FinOps team. This helps in setting expectations and accountability, ensuring that every team member knows their specific duties towards managing and optimizing cloud costs.

- Adopt and integrate suitable tools: Utilizing the right tools and technologies is essential for monitoring, managing, and optimizing cloud expenditures. These tools should be able to provide real-time data and insights into cloud usage and spending.

- Implement training and development Programs: Continuous learning and development are vital for keeping the FinOps team updated on the latest cloud technologies and financial management practices.

- Set up regular review cycles: Regularly review cloud spend and usage to identify trends, inefficiencies, and opportunities for cost optimization. These reviews should involve stakeholders from across the organization.

- Create a culture of accountability and transparency: Cultivate a culture where all departments are accountable for their cloud usage and costs. This cultural shift should be supported by transparent reporting and open communication across all levels of the organization.

- Develop and implement policies and guidelines: Establish policies and guidelines for cloud usage that align with the organization’s financial goals. These policies should be regularly updated to reflect the dynamic nature of cloud computing and business needs.

FinOps Challenges and Solutions

Here are some of the challenges associated with applying the FinOps framework.

Cultural Resistance to Change

One of the primary obstacles to successfully implementing FinOps is overcoming the cultural resistance within organizations. Traditionally, business units and IT departments have operated in silos, with minimal collaboration on budgeting and resource management. FinOps requires a shift to a more integrated approach where all teams share accountability for cloud costs.

Possible solutions:

- Engage leadership: Secure executive sponsorship to champion FinOps across departments.

- Communication campaigns: Initiate awareness programs to emphasize the benefits and necessity of FinOps practices.

- Incremental implementation: Start with small, manageable projects to demonstrate quick wins and build support for broader changes.

Lack of FinOps Expertise

There is a major scarcity of professionals who possess both deep financial management knowledge and a strong understanding of cloud technologies. FinOps is a relatively new discipline that merges these two traditionally distinct skill sets. Thus, finding or training personnel to handle both areas is often a significant barrier for organizations.

Possible solutions:

- Training programs: Invest in comprehensive training for existing staff in both financial management and cloud technologies.

- Hire specialists: Recruit experienced FinOps professionals to fill critical roles and mentor internal teams.

- Partnerships with universities: Collaborate with educational institutions to develop curricula that combine finance and cloud technology skills.

Overwhelming Data Management

Effective financial management of cloud resources hinges on the ability to collect, integrate, and analyze data to make informed decisions. Organizations often find themselves overwhelmed by the sheer volume of data, which can lead to integration issues, inaccuracies, and the inability to extract meaningful insights.

Possible solutions:

- Invest in tools: Utilize advanced cloud management and optimization platforms that automate data collection and analysis and provide actionable insights.

- Data management workshops: Train teams on best practices for data management and integration.

- Hire data specialists: Bring on board data analysts who can streamline data processes and ensure data quality.

Aligning Costs with Business Value

Aligning cloud costs with actual business value involves a detailed understanding of how different cloud services impact business outcomes and translating this impact into quantifiable metrics.

Establishing relevant KPIs and communicating the financial benefits of cloud investments across the organization demands a high level of financial acumen and technical knowledge. This process is complicated by the need to continually adapt and respond to changing business conditions and technological advancements.

Possible solutions:

- Define and communicate KPIs: Clearly articulate the key performance indicators that link cloud spending to business outcomes.

- Regular business reviews: Hold periodic reviews with stakeholders to discuss cloud spend and align it with business strategy.

- Adopt agile budgeting: Implement a flexible budgeting approach that can adjust to technological and market changes.

Best Practices for Successful FinOps Implementation

Here are some of the measures that organizations can take to improve the success of their FinOps implementation.

Establish Baseline Metrics

To effectively manage and optimize cloud costs, organizations should start by establishing baseline metrics. This involves measuring current cloud spend and usage to set benchmarks for future improvements.

Baseline metrics can include monthly cloud spend, cost per workload, cost per department, and utilization rates. By establishing these metrics, organizations can track performance over time and measure the impact of FinOps practices on cloud cost efficiency.

Leverage Predictive Analytics

Predictive analytics can be a powerful tool in the FinOps toolkit, helping organizations forecast future cloud spending and usage patterns based on historical data. By integrating machine learning models and statistical algorithms, FinOps teams can predict spikes in demand, identify potential cost overruns, and plan accordingly.

This proactive approach allows for better budgeting and more strategic resource allocation, reducing waste and enhancing operational efficiency.

Implement Cost Allocation Tags

Using cost allocation tags across all cloud resources is essential for tracking cloud spending across different departments, projects, or services. Tags allow organizations to attribute costs to the specific resources or activities that generate them, making it easier to monitor and manage cloud expenses. Comprehensive tagging ensures that every dollar spent is accounted for and linked to business value, facilitating more detailed reporting and analysis for cost optimization.

Leverage Multi-Cloud

Managing multiple cloud environments can introduce complexity but also offers opportunities for cost optimization and risk mitigation. Multi-cloud management involves distributing resources across different cloud providers to leverage their unique pricing models and features.

It requires a strategic approach to workload placement and continuous performance monitoring to ensure cost-effectiveness and compliance across clouds.

Anodot’s FinOps Solution

Anodot’s cloud cost management solution helps businesses understand cloud unit economics by aligning cloud costs to key business dimensions. This allows users to track and report on unit costs and get a clear picture of how infrastructures and economies are changing.

Anodot’s cost allocation feature helps organizations accurately map multicloud and Kubernetes spending data, assign shared costs equitably, and drive FinOps collaboration throughout your organization.

With Anodot, FinOps teams can easily classify and divide all of their cloud costs by business structures like apps, teams, and lines of business. Inform and empower business decisions at all levels from Anodot’s cloud cost management solution.