Bitcoin and Coinbase have been in some hot water lately. How they handle cryptocurrency might not be legal or safe. The lack of regulations is causing concern from the government about potential criminal activity, fraud, and money laundering.

The good news? Rules are being implemented for crypto exchanges to stop corrupt events from happening. Regulations like Know Your Customer (KYC) are an absolute must for exchanges to keep operating legally.

That’s why it’s important to learn the ins and outs of time series related to KYC and how to monitor them correctly.

Let’s dive deeper into these policies, procedures, and how third-party tools can help keep exchanges safe and secure.

The Customer Acceptance Policy

The Customer Acceptance Policy (CAP) is like a rulebook that a cryptocurrency exchange follows to make sure only legit customers are using their services. CAP will check things like identity verification and risk level to stop any illegal transaction activities. A strong CAP can help protect the exchanges and keep customers safe.

Automatic metric monitoring can be CAP’s best friend.

Making sure you comply with CAPs can be a hassle, but automating your metric monitoring can help! By analyzing large amounts of data, this process notifies exchange operators of potential issues. This helps exchanges stay ahead of the game and prevents illegal activities. In addition, machine-learning capabilities allow for refining its algorithms over time. The result? A highly effective tool for combating illegal activity and ensuring regulatory compliance.

We go beyond the ordinary by detecting anomalies in real-time, and we’re not just bragging. Discover more.

What’s the importance of Customer Identification Procedures?

It’s super important to track customer registrations and successful logins to keep a cryptocurrency exchange running smoothly. By monitoring these metrics, there can be more opportunities to spot potential product issues and address them before they become BIG problems. Not to mention, having customers who can register and login with ease is a necessity for building credibility and trust.

Tracking cryptocurrency globally

Ideally, you want to find an ML tool that can help identify geographic areas where illegal crypto activity is occurring. This can be especially useful for exchanges with global user bases, as it allows them to pinpoint issues and take targeted action to resolve them. By identifying patterns across geographical regions, MLs (Like us!) can help exchanges identify potential causes of problems and address them more effectively.

Customer Identification: Anodot in action

Let’s say an exchange is experiencing a high rate of failed logins from users internationally. Anodot can help answer critical business questions by analyzing data from these failed attempts. For example, it might reveal that the issue is related to a specific browser or operating system or that users are encountering an error message. Armed with this information, the exchange can take targeted action to resolve the issue and improve the user experience. Ultimately, this can make customers happier and improve the exchange’s performance.

Monitoring Transactions

Transaction monitoring tracks cryptocurrency transactions to detect anything fishy, like fraud or money laundering. Cryptocurrency exchanges hold a crucial responsibility to prevent using their platforms (think Bitcoin or Coinbase) for illegal activities, making transaction monitoring a must. This involves observing critical metrics – such as transaction frequencies, sizes, and volumes – to identify patterns that may indicate suspicious activity.

Tracking your transactions: why metrics matter

When it comes to monitoring transaction health, there are a few specific metrics you should be tracking – like transaction counts, values, and fees. By keeping an eye on these, you can gain insight into overall transaction volume and trends over time. Monitoring abnormal metric increases maintains transaction consistency and lets you fix issues before they become bigger problems.

The benefits of real-time alerts

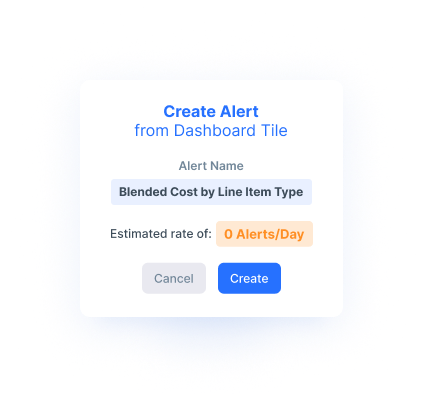

A real-time alerts feature can be a lifesaver with transaction monitoring. When payment and approval failures occur, these alerts immediately notify exchange operators, allowing them to take quick action to resolve the issue. This helps prevent fraudulent transactions from taking place and improves the overall security of the exchange. In addition, real-time alerts can help exchanges stay ahead of emerging threats and respond quickly to changing market conditions..

Did you know that Andot’s real-time alerts feature keeps an eye on vast volumes of data across different streams and metrics? Pretty cool, huh? 😎

Risk Management

Risk management involves identifying, assessing, and mitigating potential risks associated with cryptocurrency exchanges. This can range from market volatility to cyber-attacks and legal liability. Basically, if you want to manage a crypto exchange’s operations safely, this is needed!

Explanation of risk management in cryptocurrency exchanges

Many major cryptocurrency exchanges have faced U.S. Securities and Exchange Commission (SEC) investigations due to a lack of compliance. For example, Binance, Kraken, and Coinbase have all been subject to investigations related to anti-money laundering and know-your-customer regulations. These investigations can be costly and damaging to an organization’s reputation, highlighting the importance of effective risk management and compliance procedures. It’s better to be proactive than inactive!

Using ML can reduce business risk and offer necessary compliance checks

Using MLs can minimize business risk and provide necessary checks for compliance. By automating metric monitoring and providing real-time alerts, a platform (*cough *cough Anodot) can help exchanges meet their regulatory obligations. This can save you from expensive investigations (that no one wants). Plus, machine learning evolves and adapts to face new threats & market conditions, staying effective all along (which everyone wants!).

Final Thoughts

For any safe & secure cryptocurrency exchange, proper customer policies and risk management are the ingredients needed. This includes identifying customers, monitoring transactions & managing risks. Failure to implement these measures can result in significant legal and reputational risks. It’s happening now, and it’s no joke.

Automated monitoring tools aid in compliance with procedures and maintaining security in cryptocurrency exchanges.

P.S. With Anodot, you can enjoy peace of mind knowing your exchange is monitored 24/7 while beefing up your security from emerging threats! Let’s talk.