It’s never been a better time to be a Managed Service Provider (MSP). Why? Small and medium businesses (SMBs) use cloud-based services for their operations. Eighty-eight percent say they currently use an MSP or are considering one.

But many obstacles remain even if SMBs are in high demand for MSPs. They need to keep their profits and revenue growing, focusing on cloud unit economics, customer pricing strategies, and efficient operations. To be the go-to choice for cloud services for SMBs, MSPs must meet customer needs in cloud migrations and financial management.

Let’s check out how FinOps contribute to successful cloud management and how MSPs can help with this goal. (This blog is just the beginning, get deeper insights in our white paper!)

Why FinOps so important for modern organizations

FinOps is a practice that combines data, organization, and culture to help companies manage and optimize their cloud spend.

Furthermore, it brings a holistic approach to cloud financial management and helps organizations maximize their ROI in cloud technologies and services by enabling teams to collaborate on data-driven spending decisions.

The relationship between MSPs and FinOps

As cloud finance and operations experts, MSPs can help customers optimize cloud costs, standardize operations, and make informed business decisions during their cloud journey.

What does that mean? MSPs must be ready to offer FinOps services to customers who wanna level up their cloud financial management game. In a super competitive cloud services market, managed FinOps allows MSPs to stand out and build customer trust.

What you need to know for FinOps success for you and your customers

Picking the right partner solution is key to nailing your FinOps game, no doubt about it.

Since FinOps is a new approach to cloud management, limited solutions are aligned with its phases and capabilities, despite a tooling landscape with over 100 vendors.

Key tool categories to look for when selecting a cloud finance solution

When evaluating FinOps platforms, ensure they are designed specifically to deliver managed services.

Make sure the FinOps platforms you’re considering check all the boxes on this list:

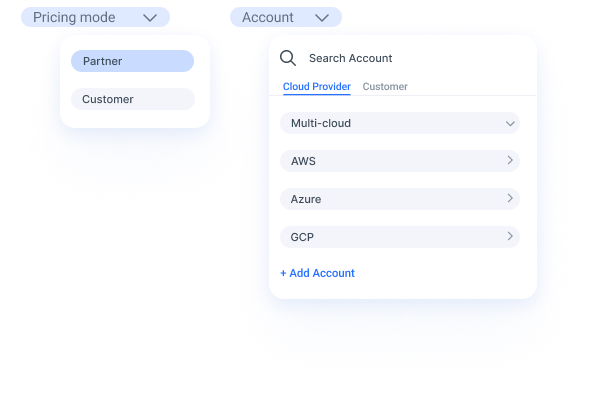

- Connect to major cloud service providers (AWS, Azure, and Google Cloud) to monitor and manage spend in complex multi-cloud environments.

- Integration to combine all cloud spending into a single platform is crucial for providing complete multi-cloud visibility and optimizing resources.

- A FinOps platform to help you successfully implement a robust tagging strategy for every customer and accurately allocate 100% of their costs across all accounts and environments.

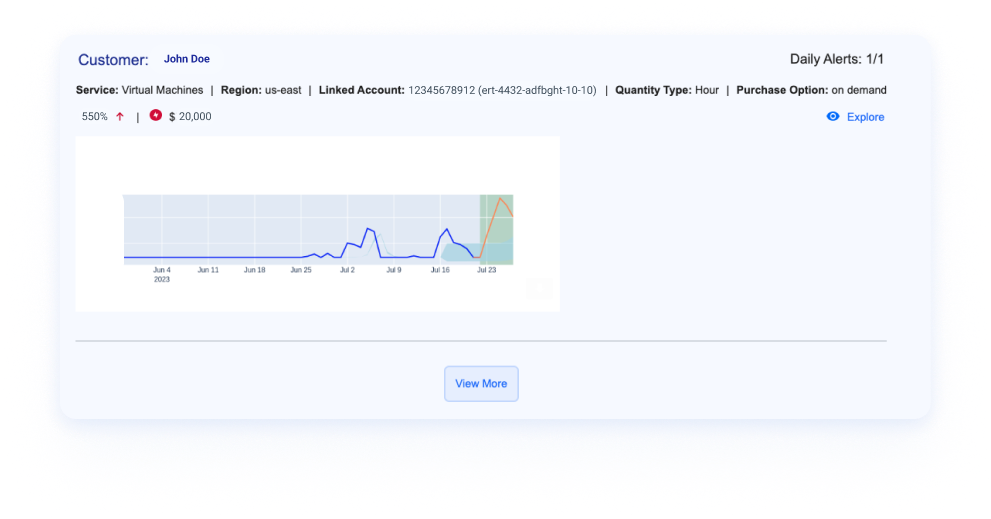

- Automated monitoring for cost anomalies. Cloud cost anomalies are unexpected variations in cloud spending that exceed historical patterns.

- Assess how effectively the platform enables waste reduction. It should automatically identify and tailor waste reduction recommendations for each customer, including idle resources, rightsizing, and commitment utilization.

FYI, Anodot checks all these boxes and then some!

Meeting these requirements is integral to FinOps and accelerates cloud-based business value. Understanding where costs are incurred, who generates them, and how they contribute value is key to achieving this goal.

Improving margins and customer experiences

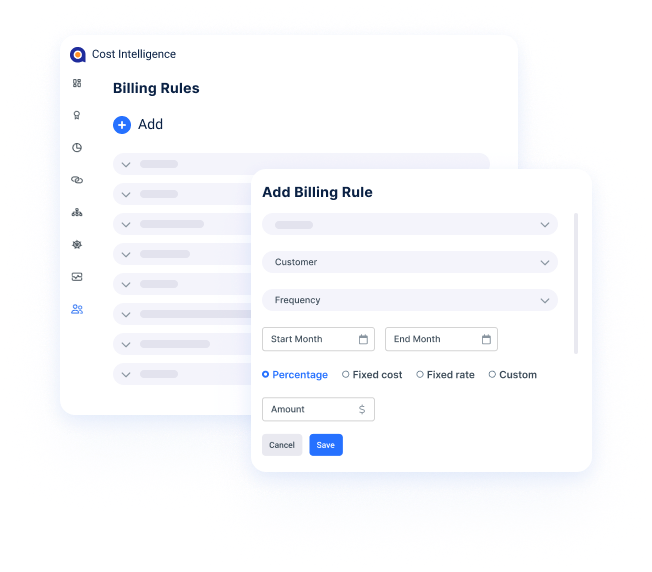

To make the most of your margins, MSPs must accurately and efficiently invoice customers using a clear pricing strategy. For many MSPs, rebilling can be a real-time suck and eat into already low margins. It gets even trickier with the mixed and unmixed rates from cloud providers, which leads to monthly invoice explanations to clients.

Flexible billing solutions for MSPs to embrace

- Allocate usage and costs to customers.

- Block out margins and bill customers with adjusted rates

- Easily add any billing rule and/or credit type

- Add charges for support and value-added professional services

- Control usage of high-volume discounts, reallocate SP/RI, and manage credits

The importance of real-time visibility into cloud costs

Additionally, Managed Service Providers (MSPs) need complete visibility into their usage, costs, and margins.

- Gain a comprehensive view of customer costs, margins, and usage across the portfolio.

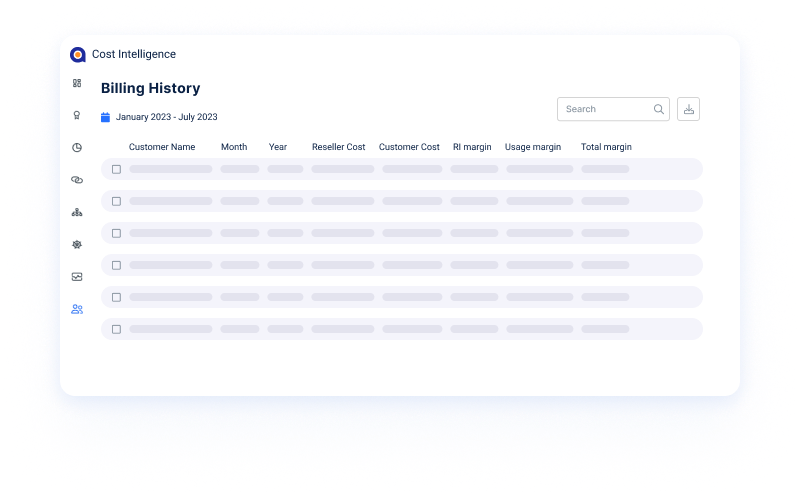

- Access a detailed billing history with a breakdown of each customer’s margin to the Service Provider (SP) and Reserved Instance (RI) level.

- Justify invoices by analyzing bills from both the partner and customer perspectives.

- Easily switch between cost views with and without margins.

MSPs go further with FinOps practices

MSPs who prioritize FinOps make systems more appealing to customers. Why? It demonstrates your commitment as a partner who helps them save money and time in cloud management. Plus, it helps you become a fierce competitor among other MSPs.

Remember to find a vendor to help optimize cloud spending while aligning FinOps, DevOps, and finance teams—without adding operational complexity or burdening management. (Hey, that’s us!)

Looking for a more in-depth analysis of how FinOps can advance MSPs? Check out our white paper!

Start optimizing your cloud costs today!

Connect with one of our cloud cost management specialists to learn how Anodot can help your organization control costs, optimize resources and reduce cloud waste.