For fintech and digital banking companies, fintech analytics is no longer “a nice to have.” Reliability is crucial, and any downtime causes customer churn and revenue loss. In a highly competitive market, real-time incident detection can make a critical difference.

Yet many companies are slow in making the best use of it their data with advanced analytics. A survey published in Fintech Futures found that 86% of Fintech companies consider it important or very important to implement data analytics. Yet, only 16% have data analytics fully deployed and functional.

Without analytics, data is little more than a pile of blocks. Think Legos: unless you assemble the pieces, it’ll never be more than a pile of plastic. The same is true for fintech analytics. You need to transform the stack of data into a structured framework to enable effective financial transaction monitoring.

The Impact of Fintech Analytics on Customer Experience and Competitiveness

To understand why data analytics is particularly critical in the fintech industry, think about how fintech came to be so popular in recent years. There’s one word that describes the fintech experience for consumers: Convenience. Fintech services offer a way to do banking ‘on the go’ or from the comfort of home without having to physically enter a bank or financial institution. Customer experience is at the heart of fintech.

What’s more, online banks can provide advanced savings options, higher interest rates, budgeting applications, and more. Without the weight of legacy applications dragging them down, digital financial institutions can add new features faster than their traditional counterparts — features that tend to work better out of the gate as well. It’s no wonder the industry hit a record $91 Billion in global funding in 2021, doubling the total from the year before.

By now, digital solutions have penetrated every industry and line of business. Credit institutions, financial transaction services, and eCommerce companies compete to provide the best possible customer experience online when managing finances or financial transactions. Clients and end-users are starting to demand data-based insights, and fintech service providers make it part of their competitive strategy.

The Fintech Future survey also revealed that 40% of fintech companies seek a competitive advantage using data analytics.

Growth Tactics Involving Analytics for Fintech Companies:

- Increasing personalization. Big data analytics facilitates personalization of the customer experience allowing fintech companies to improve marketing and customer success efforts.

- Cost savings. A natural result of efficient fintech data analytics is cost reduction. AI and ML-driven financial transaction monitoring tools allow for seamless operations and minimum downtime caused by malfunctions or glitches.

- Improving customer experience. Smoothly run operations are essential for fintech because of the sensitivity of the industry and the high risk involved. Fintech companies need to ensure transactions are secure, accurate, and reliable. This requires high granularity and real-time data monitoring.

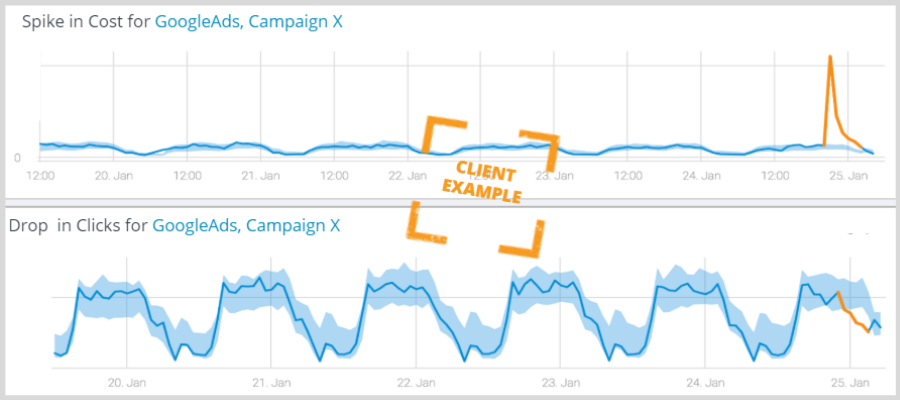

- Improving customer acquisition. Monitoring financial transaction data and existing customer metrics help you identify strong marketing channels, campaigns, and features.

- Identifying new revenue streams. Monitoring all your business metrics with real-time alerts allows you to identify opportunities and new revenue streams.

The Need for More Effective Financial Transaction Monitoring

When we look at the list of tactics, it’s easy to identify some of the challenges. Traditional dashboards and analytics solutions cannot keep up with the complexity and volume of digital banking and transactional data.

Not only are companies overwhelmed by the amount of data, but they also have a hard time coordinating the analytics needs of the various business units because each use their dedicated sets of data analytics tools. This creates data blindspots and causes data to fall through the cracks.

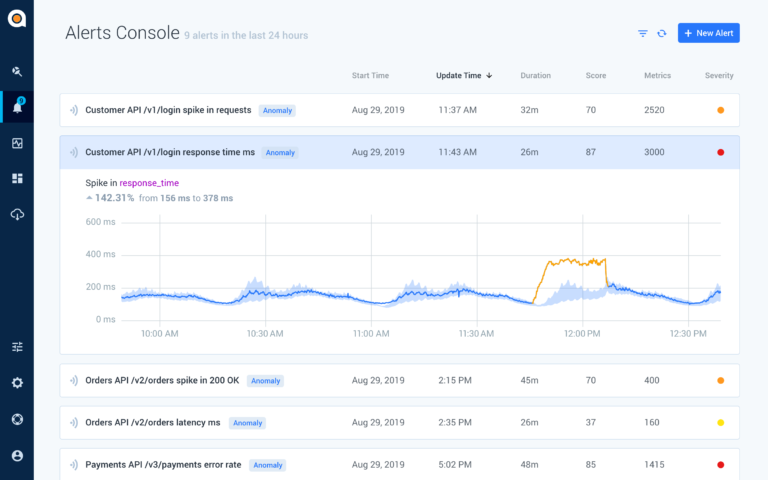

In addition, fintech companies are increasingly implementing automated processes to improve efficiency. That includes automated processes to operate the site, marketing automation, and chatbots. As long as they function smoothly, customers are happy, and the revenue keeps flowing in. But what if there’s an error somewhere — a broken API, a glitch, or a breach? Companies can lose the trust of customers and significant amounts of money when these go undetected.

The risk for fintech companies without real-time financial transaction monitoring is higher than in other industries. To achieve a competitive advantage and meet their KPIs, fintech operations need AI powered analytics solutions that provide real-time insight into transaction data, payment behaviors, merchant activity, etc.

Another challenge is the growing demand for personalization and the illusion that this tactic alone can strengthen customer loyalty. It seems like a magic word in fintech, eCommerce, and digital marketing. However, a personal notice can’t make up for a terrible customer experience.

If an online payment suddenly hangs in the middle or is too slow, customers may panic, “Did the payment go through? Do I need to resubmit? What’s happening with my money?” No amount of personalization will bring the customer back if they lost money or confidence due to poor operational functionality.

Proactively Manage Financial Transaction Incidents with Anodot

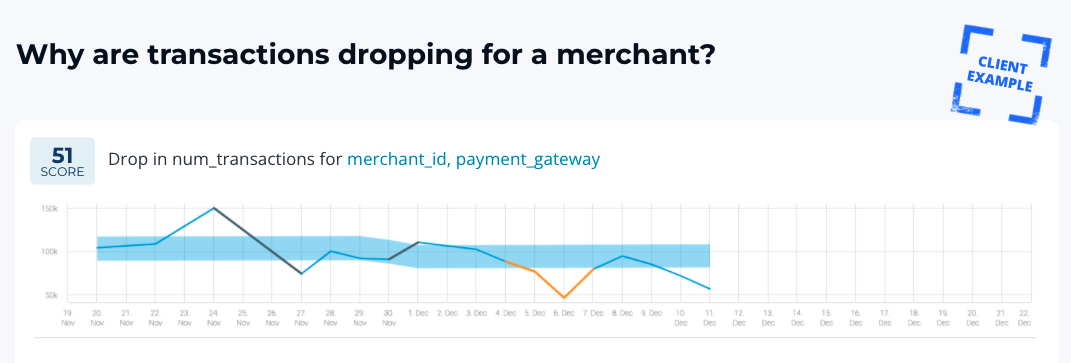

Every transaction, click, purchase, etc., generates a data point, and together they form a vast number of data streams. Anodot’s Machine Learning capabilities automatically learn streaming data’s normal behavior, including seasonal and other complex patterns in every single metric.

The system immediately detects unusual data behavior, correlates with other metrics, and sends alerts on any combination of metrics that behave abnormally. Anodot provides fintech companies the tools needed to detect and diagnose issues early, resolve them quickly, and take preemptive actions before they turn into crises. This is a drastic change from the static nature of BI as it exists today.

Use cases for fintech include:

- Payment Processing – Identify unusual drops or increases in error rates across multiple payment entities, geographies, devices (e.g. inability for Android users to submit payments using Visa); flag unusual number of payment declines or credit card refusals

- Partner Integration – As a fintech provider it is crucial to assure the health of your customers’ integrations. A code push on either side can potentially break the integration and cause a lose-lose situation.

- Personal Finance Apps & Websites – Keep partner offers running smoothly by tracking offer integration, conversion, devices and more; identify campaign effectiveness

Anodot’s AI-powered platform can monitor 100% of a fintech companies data in order to:

- Ensure smooth functionality

- Reduce downtime + save costs

- Fix issues before they impact customers

- Provide an excellent customer experience

- Increases customer loyalty based on reliability

- Identify opportunities

- Effectively protect revenue

Real-Time Data Analytics Is a Keystone in the Future of Fintech

In a broader sense, fintech is the digitization of financial transactions and finance in general. Experts see fintech becoming embedded in other services instead of a stand-alone service; they predict AI-powered financial advisors replacing human consultants and Fintech-as-a-Service becoming a standard model.

Wherever the fintech industry is heading, AI-powered fintech analytics are at the center. Anodot offers a robust, holistic, and forward-thinking solution for smoothly running fintech operations. Complete business monitoring allows for the growth companies pursue.