Having spoken with many companies, I’ve learned that while they all monitor their application performance, infrastructure, product usage, conversion rates and a variety of other user experience parameters, very few monitor the actual transactions from their payment provider.

Although user experience is very important and issues around UX and application performance sometimes relay to revenue loss, not all revenue loss can be seen when exploring user performance and not all user performance issues affect revenue.

Do you monitor your payment provider data? Do you monitor the transactions?

As we grow our own company, we pay special attention to business monitoring for identifying revenue-critical issues – the clear-cut cases of ROI. And we’ve found that there is nothing more important than monitoring your actual revenue streams. Because that’s the single most important KPI for your business, isn’t it?

How can I monitor my transactions?

Whether you use Due, Stipe, Paypal, Bluesnap, Square, or something else, payment providers expose an API to grab your transactions.

To monitor these streams, you can simply feed this log into Anodot daily, hourly or even as a live stream (based on the frequency of your transactions).

Anodot will learn your transaction, how many transactions to expect every day including volume, currency, location, product id and any other relevant dimension.

As soon as you experience a drop in payment from a provider, platform or any other parameter we will identify it and ping you.

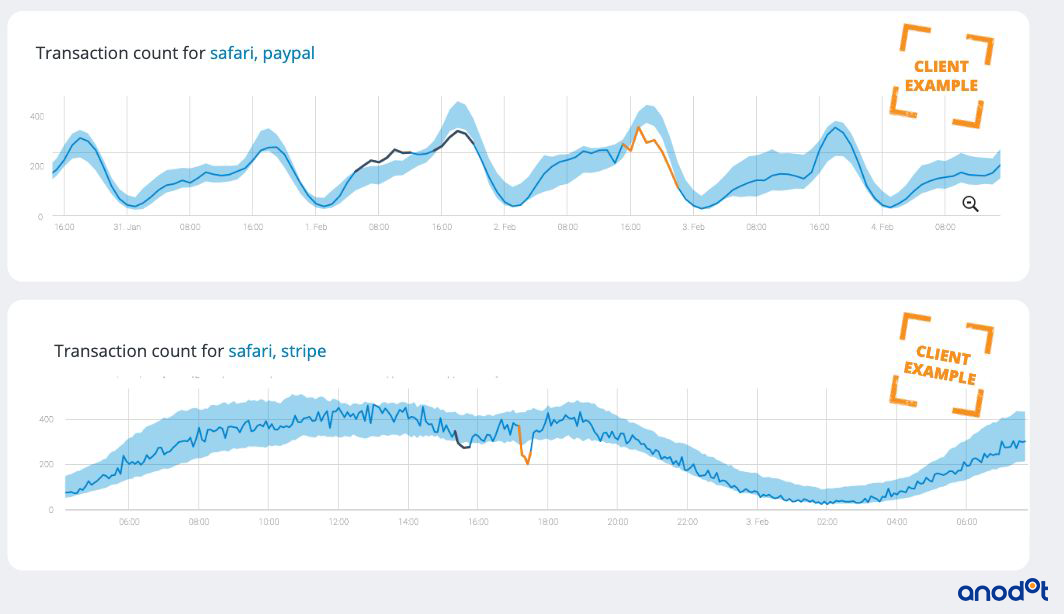

In this case, an Anodot customer experienced a drop in transactions for a few minutes. We were able to identify an anomalous dip in transactions made on Safari browsers via Stripe and Paypal after a faulty version release. The cause? A developer coding error in a continuous integration continuous deployment environment.

Anodot identified the issue immediately and correlated the drop in Paypal and Stripe payments via a single alert. That’s right – just one alert. We served our customer the full story, including the recent version release, and that helped them to fix the issue within minutes and prevent significant revenue loss.

These transactional incidents have a direct effect on revenue. But when you monitor user engagement or application performance you may not necessarily pay attention to these kinds of incidents. For this reason, payment transactions should be the cornerstone of your monitoring strategy. Build a system where they can learn different pattern types, track in real time and correlate different metrics and events into a coherent, comprehensive story.