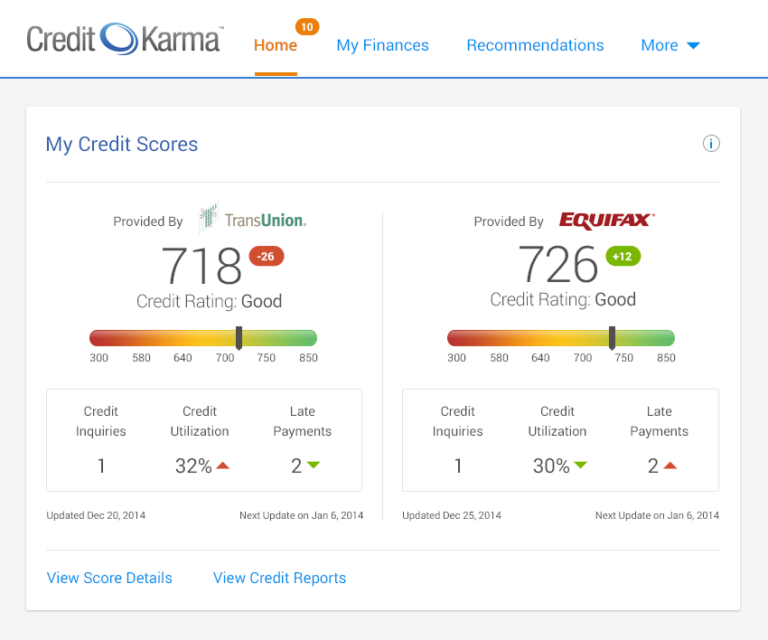

We are excited that Credit Karma selected Anodot for their business incident detection needs. In case you haven’t heard, Credit Karma provides free credit scores and financial recommendations to 50 million members. They chose Anodot after they had tested multiple monitoring solutions and considered developing in-house.

With hundreds of thousands of business and technical metrics to monitor to keep business running smoothly, the multiple teams within Credit Karma have used various tools, but still had delays of 24 hours or more before they could identify important business incidents.

“It used to take us up to several days to identify an issue on a specific page, offer, or service that was draining our revenues,” said Pedro Silva, Credit Karma’s Senior Product Manager. “Anodot identifies when a metric increases or decreases in real time, so we can resolve it quickly, before business suffers or revenue is lost.”

“We see many companies that encounter a similar problem to Credit Karma; they collect massive amounts of data but do not have a way to access the insights that are meaningful for the business in real time,” said Uri Maoz, Anodot’s head of US Business. “Today’s business intelligence solutions are too static to keep pace with the dynamic nature of online and mobile business; Anodot’s real-time machine-learning driven solution is becoming a must-have for web-based businesses.”

Today, using Anodot, Credit Karma identifies several relevant and actionable issues that have a business or technical impact each day.

Credit Karma’s revenue analytics, technical analytics and marketing teams are currently relying on Anodot’s business incident detection; the eventual goal is to roll out access to Anodot to all the teams in the company.

Seamless Integration for Immediate Impact

Anodot’s ability to seamlessly integrate with Credit Karma’s existing infrastructure was a key factor in their decision to choose our solution. The implementation process was smooth, allowing Credit Karma to start benefiting from real-time insights almost immediately. This quick turnaround time has enabled them to prevent potential revenue losses and maintain a high level of service quality for their members.

Future Expansion and Proactive Monitoring

Looking ahead, Credit Karma plans to leverage Anodot’s advanced capabilities to further enhance their operational efficiency. By expanding the use of Anodot across more teams, they aim to proactively address issues before they impact the business, ensuring that they continue to provide their members with accurate and timely financial recommendations.

To learn more about how Credit Karma uses Anodot to identify relevant and actionable incidents each day, read the full case study here.

Read the full press release here.